Equestrian insurance

Equestrian insurance

(on the example of Rostov and the Rostov region)

Equestrian sport is gaining popularity every year. So, if in the Rostov region a couple of years ago there were no more than 20 equestrian clubs, today their number exceeds 50 clubs. In Taganrog alone and its environs there are 6 equestrian clubs and only one of them is state-owned. More than 70 competitions are held annually, each of which involves at least 10 sports couples.

At the same time, it is no secret that equestrian sport is considered one of the most traumatic: cases of injury to riders in terms of frequency are in 10th place among other sports, however, it is equestrians who receive the most serious injuries compared to other athletes (in 39% of cases they are expressed in fractured bones [1], 75% of injuries do not occur while riding, but while handling horses.2 According to the journal NZMJ, injuries resulting from contact with horses occurred in 15% of cases on farms, in 15% in places equipped for equestrian sports, and 3,5% – when moving a horse on the roads [3].And this is taking into account the strict rules of equestrian sports in Europe, where the trainer must receive special education, where there is an insurance system, where the activities of clubs are licensed .

In Russia, for most horse owners, equestrianism is more of a hobby than a business. Many clubs don’t pay off, so owners are reluctant to invest in non-essential activities. This activity is not licensed, many coaches do not receive special education, clubs do not have the necessary material and technical base. In addition, insurance in the implementation of this type of activity in the Russian Federation is not required. There are no modern statistics on injuries in equestrian sports, as they try to hide it.

Equestrian sport according to injury statistics is not included in the top ten dangerous sports. However, falling from a horse is an essential attribute of riding. In the everyday life of horsemen there is a half-joking saying – until you fall, you feel sand on your teeth, and a lump on your head, you are not yet a real rider. At the same time, very few people know how to fall.

Of course, horsemen are aware of the risk they face. Each of them at least once in his career received injuries of varying severity. Actually, when the question of insurance is raised, we are not talking about bruises and bruises. It is much more important that the risk of receiving really serious injuries, both rider and horse. At the same time, one cannot ignore that both the rider and the horse can die (although such cases are extremely rare, usually in such types of CS as steeplechase, triathlon, show jumping).

Less than half of the participants reach the end of the steeplechase, many of them get injured at the slightest mistake: high speed, indestructible obstacles and a 500-kilogram animal that has lost its support reduce the chances of a safe fall. Great risk of being trampled.

In triathlon, the most dangerous part is the cross – aboutThe danger lies not only in indestructibility, but also in the width and variety of obstacles.

Jumping is an Olympic sport. It is the least traumatic, since a destructible obstacle leaves chances for a successful fall.

Separately, it is worth noting the jumps. They are not an equestrian sport, so injury statistics cannot be found. The danger of horse racing is that animals can fight or stumble and fall at high speed along with riders.

Equestrians certainly understand that they are exposing themselves, horses and third parties to a number of risks. To understand how they feel about insurance, they conducted a survey in which 100 people aged 16 to 61 took part, in one way or another connected with horses and (or) equestrian sports – groomers, grooms, trainers, administrators, veterinarians.

100% of them responded positively to the question of whether they need insurance in equestrian sports.

However, despite the fact that equestrians are aware of the need for insurance in equestrian sports, they are in no hurry to insure themselves and their property.

It is necessary to find out which types of insurance may be most relevant, and why they are not used in practice.

The legislation provides for four main types of insurance:

- personal (property interests associated with a person are insured – life, health, ability to work);

- property (aimed at insurance of property interests);

- liability insurance (liability associated with damage is insured);

- business risk insurance.

The Civil Code of the Russian Federation determines that insurance can be both voluntary and mandatory, including mandatory state insurance, while the risks against which an individual or legal entity can be insured are not specified.

We conducted a series of surveys among representatives of equestrian sports regarding the need for insurance. The results were not unexpected: athletes are most interested in accident and injury insurance, life insurance (their own and the animal). Some people are interested in civil liability insurance (including liability insurance for organizers of sports events).

Note that some insurance companies offer an extended list of types of insurance:

- insurance against the risk of death or loss of animals. Death is also understood as death from disease, slaughter for humane reasons or by order of regulatory authorities during an epizootic;

- insurance against the risk of depreciation of the horse’s value caused by illness or injury, which leads to the reduction or loss of the horse’s ability to work or loss of its value;

- insurance of the risk of expenses for veterinary care during transportation.

Not all horse owners are aware of these types of insurance, but they are of paramount importance when the value of the horse is very high and (or) when the horse is initially purchased for subsequent resale.

On October 14, a conference was held in Rostov with the support of the Don Horse Owners Association, where insurance issues were discussed. The result was stunning: even the invited insurers did not know what to offer such clients.

On April 2, 2016, we sent a letter to 10 Taganrog insurance companies with the following content:

“Hello, we teach horseback riding. This sport is quite traumatic, so we would like to use the services of an insurance company, but we do not know how best to do this. What list of services could you offer us? What’s the price?”.

Of the 10 companies, only Yugoria answered us, the representative office of which is not in Taganrog. We were offered to transfer our request to Rostov.

At the same time, it would be possible to develop a gradation that determines the basis of the cost of insurance:

- breeding animals;

- sports animals;

- young;

- hobby horses.

The amount of the insurance premium is determined by the market value of the animal. But how to determine it, if the cost can change during the season? Based on the purchase price, it will be underestimated. It is possible to conduct expert examinations, but in Russia there are no experts who would determine the market value of horses.

First of all, the equestrian is interested in the life and health of his animal. Horses are fragile creatures, they can harm themselves or even die in fairly ordinary situations. In the Rostov region, the situation is complicated by the lack of qualified veterinarians and the shortage of effective veterinary drugs.

It is important that the horse is insured against accidents, because in this way the owner does not have to worry if something happens to him. And there are many examples for excitement: colic, accidents, and other factors. Quite recently, in one of the Rostov equestrian clubs, a stallion broke his leg just walking in a levada. A couple of months before that, a young private horse fell – it just stood in the stall … Both owners suffered huge losses: in the first case, the horse cost 500 thousand rubles, in the second – a million. In addition, they had to bear the costs associated with the post-mortem examination and disposal of the bodies.

In the Nizhny Novgorod region in June of this year (2017), the driver lost control and knocked down a horse standing on the road [4]. And such accidents, unfortunately, are not uncommon.

In October 2016, a tragedy occurred in the Vivat farm (Moscow region) – a seven-month-old Trakehner foal, the only heir of Hip Hop, belonging to the rare and unique Kupferhammer line, received an injury incompatible with life [5], because the hunters decided to shoot next to the horses .

The horse can be stolen. So, in the Moscow region, for the second year in a row, horse thieves have been operating, having already stolen more than a hundred horses!

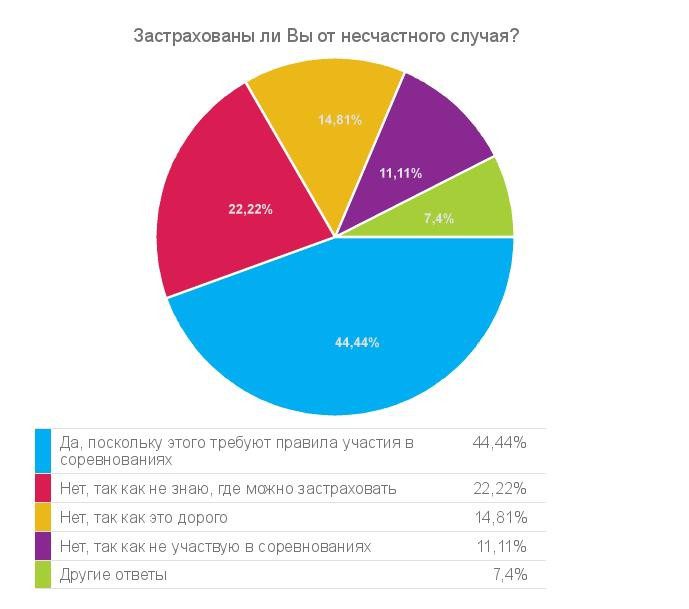

As part of the survey, we asked: “Is your horse insured against an accident?”. The results are presented in fig. one:

We see that in most cases equestrians do not insure horses against accidents, because they do not know where this can be done, and also because they consider the services to be too expensive.

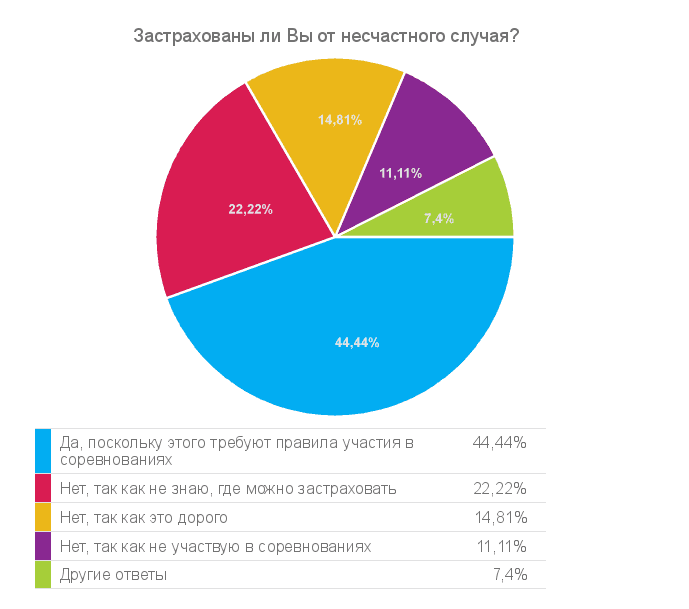

A different situation develops in the insurance of the equestrian himself against accidents (Fig. 2):

According to the results of the survey, the majority is insured against an accident, as this is required by the rules for participation in competitions. They know where to get insurance, but many consider these services to be expensive.

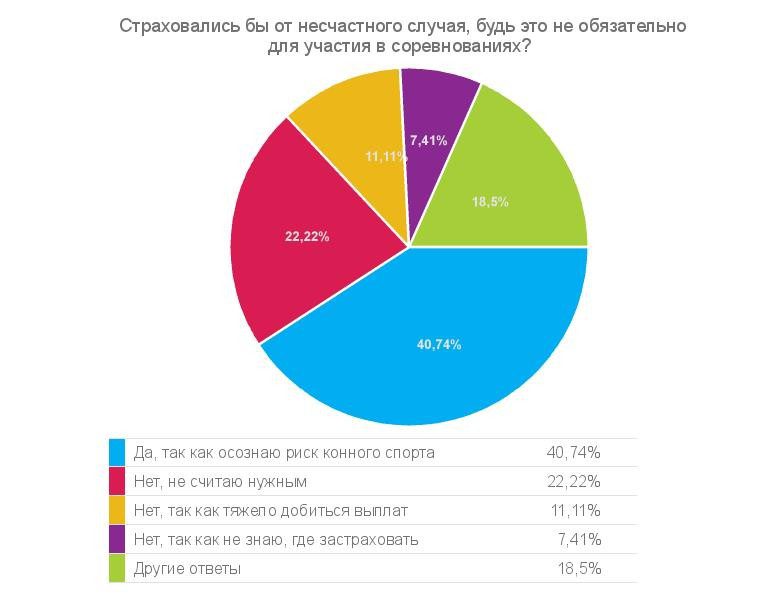

The results of a survey of equestrians about whether they would be insured against accidents if the rules allowed them to compete without insurance are shown in Fig. 3.

Most of the respondents would prefer to insure, this is not accidental. Trauma, an accident are associated with the risk of disability. In equestrian sports, partial or complete disability implies the end of a career without the possibility of retraining.

Many of those who would choose not to take out insurance point out that it would be difficult to get insurance payouts. Practice shows that their beliefs are not unfounded.

Google finds more than 9 videos for the query “horse attacked man”. It can be concluded that horse attacks are not uncommon. This often happens when a person decides to take a picture with a horse or stroke it, and the animal recognizes this as an attack, gets scared and hits “first”.

Often for the same reason horses “attack” cars. So, in Izhevsk in March 2017, a horse jumped on a car [6]. Reason for action the victim is not as important as his car. Of course, such an event is regarded as an accident. Only a horse is not a car, so it does not have OSAGO.

A more common example is a client falling at an equestrian club. Who is responsible? Club, horse owner? In Moscow and St. Petersburg, this issue is resolved by one-time insurance or insurance covering all subscription sessions.

Competition organizers also bear huge risks, because competitions are expensive. Insured events are varied:

- fire, collapse of capital structures;

- food poisoning of participants or spectators;

- other cases of causing property damage to participants (including the death and injury of horses).

Rare owners insure civil liability. In the course of the study, we decided to find out why.

As it turned out, the majority (92% of respondents) consider the horse a source of increased danger, but no one (!) has insured their civil liability.

The most common reasons are misunderstanding of the term (20%), ignorance of where you can insure (25%). 16% of respondents simply do not consider it necessary to insure. The same number is not insured, since such insurance is not required.

At the same time, 80% of respondents believe that civil liability insurance is necessary.

Insurance in equestrian sports, according to equestrians, is necessary, but should not become mandatory, since the corresponding expenses will further increase the financial burden of the horse owner. 28% of equestrians trust insurance companies and are ready to cooperate with them, 44% find it difficult to answer.

During the study, we found that equestrians are aware of the risks, but are in no hurry to insure, because:

1) have a low level of legal literacy;

2) have a low level of awareness of the activities of insurance companies;

3) find insurance expensive;

4) believe that it is easier to cope on their own than to obtain payments from the insurance company;

5) believe that the insurance system has not been worked out, therefore there is no judicial practice.

The insurance market in this area continues to be unoccupied, it is promising, but the level of literacy of both equestrians and insurers needs to be improved.

In this case, it is necessary:

- increase customer focus of insurance companies;

- increase the level of legal literacy of equestrians;

- develop insurance programs for equestrians: for those who keep one horse, two or more than two;

- develop a gradation that allows you to determine the cost of insurance services;

- prepare experts, develop an examination system for determining the value of horses.

[1] Murom B. “How to avoid injuries” // “Horse breeding and equestrian sport” No. 4, 1983. P. 16

[2] W. Heipertz, K. Steinbrück «Horses with slouches» // Reiter Revue, №12, 2011.

[3] Northey, G. Equestrian injuries in New Zealand, 1993–2001: knowledge and experience // NZMJ. – 2003. – Vol. 116, № 1182. – P. З74.

[4] Portal ProCity. Novocheboksarets, who died in an accident with a horse, went home for the holidays [Electronic resource]. URL: http://pg21.ru/auto/34025.

[5] Sportbox.ru. Who is to blame for the death of a foal? Unanswered question [Electronic resource]. URL: http://news.sportbox.ru/Vidy_sporta/horse_world/spbnews_NI677717_Kto_vinovat_v_smerti_zherebenka_Vopros_bez_answer.

[6] Votkinsk. Yes. In Izhevsk, a horse “attacked” a car [Electronic resource]. URL: http://votkinskda.ru/news/v-izhevske-loshad-napala-na-avtomobil.

Victoria Donskaya, KSK «Golden Horse»